Presentation

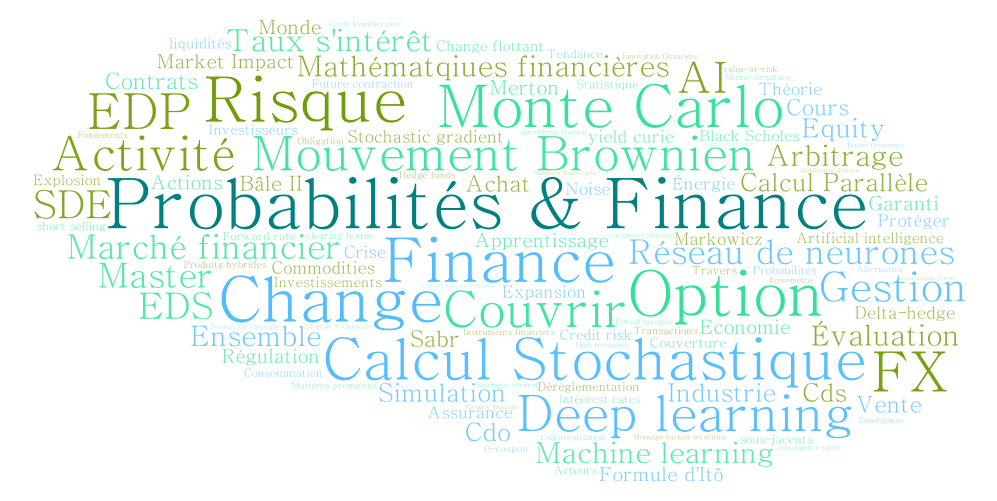

Financial markets are at the heart of the functioning of the global economy. The complexity of the phenomena involved requires scientific training advanced so that you can understand some of the most fundamental aspects of modern finance and to act in the markets in a relevant and responsible manner. The objective of the Probability and Finance Specialty is thus to provide students with high-level education in the field of mathematical finance. This covers all of market finance, with particular emphasis on

- Risk management of derivative products

- Algorithmic and statistical finance

- Modeling of interest rates

- Portfolio management

- Financial regulation

- Fintech and blockchain

- Energy markets

The aim of the training is therefore to provide students with the tools allowing them to formulate quantitatively the questions and challenges associated with these themes of finance and to resolve them. To achieve this, it will be necessary to rely in particular on

- Advanced stochastic calculus

- Stochastic control

- Numerical analysis and optimization

- Monte-Carlo methods

- Statistics of processes

- Machine Learning, Deep Learning

- Stochastic algorithms and high performance computing

- Differential games

The skills acquired will allow students to orient themselves towards a large number of players in the financial sphere: investment banks, hedge funds, market makers, portfolio managers, market platforms, regulators, insurers … but also to continue if they wish their training through an academic PhD or in partnership with a company.